cash app venmo zelle tax

Unlike Zelle Venmo functions as a digital wallet allowing you to accrue money in. Some gig workers and small business owners are reportedly using Zelle to dodge a tax rule that requires Cash App PayPal and Venmo to report users business.

If You Use Cash App Venmo Zelle Or Paypal You Should Watch This Video I Received Money From Cash App Venmo And Paypal Should I Declare Them For Tax Purposes

Small Businesses are Using Zelle for Tax Loophole.

. 2 days agoThe news. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. The Internal Revenue Service is cracking down on people who underreport earnings received through digital payment apps such as PayPal Venmo Cash App Zelle and others.

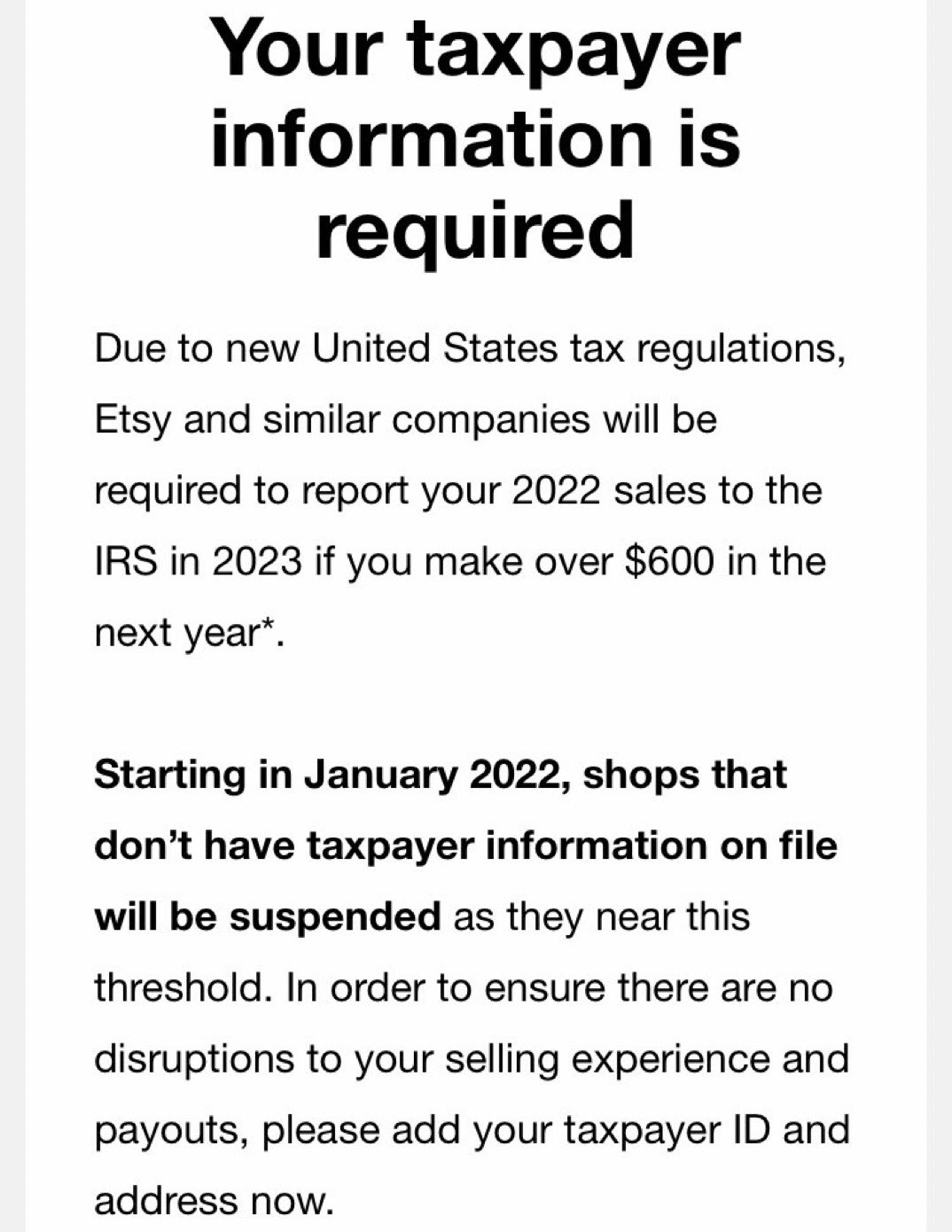

Under the IRS new rules the online payment giants such as Venmo PayPal and Cash App were told to report commercial transactions of 600 or higher starting January 1. On it the company notes this new 600 reporting requirement does not. Venmo is a social payment app you can use to exchange funds with people and businesses.

As of January 1 2022 the use of third-party payment networks such as Venmo Cash App or Zelle for transactions amounting to more than 600 per year in exchange for. No Venmo isnt going to tax you if you receive more than 600. At this time Zelle.

A recent piece of TikTok finance advice has struck terror into the hearts of payment app users claiming that anyone who receives more than 600 on platforms like Venmo Zelle. As of Jan. The short answer.

Rather small business owners independent. Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo. A new tax rule will impact millions of small businesses in 2022.

Venmo Zelle Cash App or any third-party settlement provider thats accepting credit cards on your behalf. The IRS requires the payment app to send you a 1099-K by January 31 if you received more than 600 in commercial transactions during the preceding tax year. Some finance TikToks are spreading misleading advice.

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue. Many TPSOs such as PayPal and Venmo and others like Cash App have separate accounts that allow users to identify which of their transactions are for goods and. Squares Cash App includes a partially updated page for users with Cash App for Business accounts.

Over the past year it is becoming more common for small businesses to no longer accept 3 rd party payment options. Early this year Benson Gitau owner of Houston appliance reseller Vendapp noticed that his suppliers were no longer accepting payments through Venmo. Early this year Benson Gitau owner of Houston appliance reseller Vendapp noticed that his suppliers were no longer accepting payments through Venmo PayPal or Cash App.

New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report certain. Things get tricky when youre using apps like Venmo Cash app or Zelle. Cash App Taxes - 100 Free Tax Filing for Federal State Tax filing made fast easy and 100 free Estimate your refund File now Loved by Millions Over 38 million returns rated 48 out of 5.

These services dont provide the tax reporting information needed for you to properly report earnings for your. By Jennimai Nguyen on October 21 2021. Prior to the rule Venmo and other apps issued 1099-Ks only for customers with gross payments exceeding 20000 who had made more than 200 of these transactions.

But keep reading and we will cut through the marketing hype and dig into the details of these and other services to help you decide which online rent. This new rule applies to paying cash app taxes including on income received through PayPal Venmo Cash App and most third-party payment networks.

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Tax Changes Coming For Cash App Transactions

Surprise Surprise Don T Say I Didn T Warn You R Wallstreetbets

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Is It Safe To Pay Rent With Venmo Paypal Or Cash App

Beez On Twitter People Really Fell For Tax The Rich Campaign This New 600 Tax Law Isn T For The Rich Etsy Sellers Are Now Required To Pay Taxes If They Earn Over

Cash Apps Victims Of Venmo And Zelle Scams In Kentuckiana Learn Expensive Lessons Wdrb Investigates Wdrb Com

Venmo Zelle Paypal Apple Pay And More Best P2p Services

Venmo Vs Cash App Vs Zelle Are Mobile Payment Apps Safe

Cash App Venmo And Zelle May Want To Distribute Us Stimulus Payments

Starting This Year Know Your Buyer Laws Start Coming Into Effect For The Us Digital Payment Services Like Paypal Venmo Zelle Cash App Or Any Third Party Settlement Provider Will Report To Irs

Venmo Paypal And Zelle New Tax Reporting Rules

Why Banks Don T Like Cash App Zelle Venmo Or Paypal Budget Bankruptcy Make Money Capital One Youtube

Cash App Vs Venmo Vs Zelle Vs Paypal Youtube

P2p Payment Apps Market Is Thriving Worldwide By Top Leading

New 1099k Threshold Change 600 Taxes Can I Avoid Irs Tax Form For Venmo Paypal Cashapp Zelle Youtube

New Law Impacting Peer To Peer Payment App Users

Venmo Vs Zelle Vs Cash App Pros Cons Payspace Magazine

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor